Built To Thrive

In Uncertain Times

A diversified portfolio of the world’s leading crypto hedge funds.

Targeting optimal risk-adjusted returns in USD, BTC and/or ETH.*

We evolve with the industry and regularly rebalance, so you don't have to. Review our performance here:

Amphibians Leap Multiple Times

Their Body Length.

We Aim for Excellence across Every Metric.

Amphibian Unite

Our consortium of 159+ of the world’s leading Digital Assets Funds, Market Makers and Traders.

Assets Under Management

(Projected as of 5/27/25) across our USD, BTC & ETH funds**

YTD Performance

Estimated YTD Returns for our USD Alpha Fund as of 6/30/25

GPs & Team Members

Across our various funds

GP/Team AUM experience

Combined we have managed this amount across multiple asset classes

*Our net performance estimate is derived from performance estimates from each underlying fund in our portfolio. As we do not have final official statements from all underlying funds, our estimated performance will be adjusted as we receive more official statements, but is our best estimate as of the time of this email. Note: this is based on an investor who invested since inception in our onshore feeder with a 2/20 fee structure and high water mark. Depending on your fee structure, feeder structure and timing of investment, it would differ your actual net performance.

**This figure is based on current estimates and is subject to change due to market fluctuations and other factors.

***The Digital Assets Awards are based on a no fee nomination which is vetted by The Digital Banker research team. All shortlisted firms are reviewed by an impartial panel of judges for the various award categories. Amphibian Capital has paid a fee for use of the award badge. The receipt of these awards is not indicative of future performance.

Amphibians Are Adaptable.

We are engineered to be resilient, across multiple weather conditions.

- WHO

Accredited investors, Large BTC & ETH Holders, Family offices, Institutional investors

- What

There are 1000+ crypto hedge funds globally. We’ve reviewed 700+, done deep due diligence on the top 200+, and allocated our leading 10-15+ in one portfolio.

- How

Investing is simple, liquid & transparent. Plus we have a 6% soft hurdle rate, so anything less there’s no performance fee.

- WHY

Our funds are targeting double-digit net average annual returns in USD, BTC and/or ETH over a 5-10+ year period.

Amphibian Capital Thesis

It’s Simple…

- We are bullish on BTC & ETH over the next 5-10 years

- We expect volatility & inefficiency in the market to continue

- 10-20+ year target: 2-3x+ ETH, BTC and/or USD over this time period

- Current target: 2-4% net per quarter

See our performance by fund here:

Not Your Keys, Not Your Coins They Say...

Even Cold Storage has Risk. Is 0% yield still worth it?

BTC on BTC Yield Live &

Pro-Forma Results*

Amphibian BTC Alpha Pro-Forma Net Performance Since 1/1/19: 169.29% (BTC on BTC)

*Pro forma performance, representing the average annualized performance from January 2019 through July 2023, net of all fees, for the portfolio of underlying funds that Amphibian Fund invested in beginning on August 1 2023, if the same portfolio had been fully invested as of January 2019 with no rebalancing. Please note each fund was added to the portfolio at a different time, and beginning on August 1, 2023 actual net fund performance is included. All underlying fund performance has been included from the date each fund was added to the portfolio. Note each underlying fund is the best estimate we have for the BTC share class. Not all were live as long as USD funds (so subtracted off funding costs etc for those time periods). This fund selection mirrors our latest ETH portfolio and a number of lessons from 13+ months of live data with that portfolio. In years prior to 2023, we’ve done our best to keep allocations to the max limits and adjust accordingly. Also know weightings over time would be slightly inaccurate as month on month weightings shift, depending on terms. **The Fund had approximately 5% exposure to FTX in November. This was marked as zero, but anticipate a high % of recovery given $7.3B has been recovered (30-50c on the dollar) ***Best projected estimate for July as of 7/23/24.

*Pro forma performance, representing the average annualized performance from January 2019 through July 2023, net of all fees, for the portfolio of underlying funds that Amphibian Fund invested in beginning on August 1 2023, if the same portfolio had been fully invested as of January 2019 with no rebalancing. Please note each fund was added to the portfolio at a different time, and beginning on August 1, 2023 actual net fund performance is included. All underlying fund performance has been included from the date each fund was added to the portfolio. Note each underlying fund is the best estimate we have for the BTC share class. Not all were live as long as USD funds (so subtracted off funding costs etc for those time periods). This fund selection mirrors our latest ETH portfolio and a number of lessons from 13+ months of live data with that portfolio. In years prior to 2023, we’ve done our best to keep allocations to the max limits and adjust accordingly. Also know weightings over time would be slightly inaccurate as month on month weightings shift, depending on terms.

**Best projected estimate for June as of 6/30/25.

Grow BTC on BTC, While Minimizing Risk…

Amphibian Capital’s conservative target is 12%-15+% net APY yield to create more Alpha for long term BTC holders (USD/ETH also), while derisking through one of the world’s first crypto fund of funds approach

ROBUST DILIGENCE

& RISK MANAGEMENT

- Institutional grade risk management, 98% of funds don’t meet standards

- Yield achieved through inefficiency and volatility of crypto vs purely direction

- 5+ sharpe**, portfolio optimized through our proprietary algo & 13 months of live data in USD/ETH funds

LIQUID, LOW CORRELATION ASSET CLASS

- 0.09 correlation of yield to traditional assets & BTC price

- Monthly liquidity (after 6 month lock-up)

-

Fund of funds model to diversify

strategies & manage risk

Targeting CONSISTENT RISK-ADJUSTED RETURNS*

- 12%-15% net target in non-bull years

- 75%-100%+ target net returns across potential 4 year cycle**

- Counterparty Risk***: -1.54% annual average impact across last 5 years

*Pro forma performance, representing the average annualized performance from January 2019 through July 2023, net of all fees, for the portfolio of underlying funds that Amphibian Fund invested in beginning on August 1 2023, if the same portfolio had been fully invested as of January 2019 with no rebalancing. Please note each fund was added to the portfolio at a different time, and beginning on August 1, 2023 actual net fund performance is included. All underlying fund performance has been included from the date each fund was added to the portfolio. Note each underlying fund is the best estimate we have for the BTC share class. Not all were live as long as USD funds (so subtracted off funding costs etc for those time periods). This fund selection mirrors our latest ETH portfolio and a number of lessons from 13+ months of live data with that portfolio ** Not a promise or guarantee the crypto 4 year cycle will continue *** Only one major counterparty ‘exchange’ event impacted our underlying funds by more than 3% total AUM in the last 5 years. Avoided all others. That was with FTX and approx 4.5%-6% impact on our USD & ETH fund. This breaks down to 8.5% exposure on USD, current bids on secondary markets and potential forecasts indicate a likelihood to recover 30c-50c on the dollar. This translates to 4.5%-6% potential impact). Outside of this, we had one other event from an underlying fund with 2.7% portfolio drawdown. This translates to approximately 1.54% average counterparty risk across the last 5 years. Our max portfolio strategy drawdown monthly target is < 1.5%, our max counterparty drawdown target is less than one year of yield target with -9.9%.

**Estimate based on daily data from the underlying funds. It reflects the risk-adjusted performance of the portfolio but should be viewed as indicative rather than precise, given the inherent variability in daily data and external factors affecting the portfolio’s returns.

Introducing a Few of our Team Members

MANAGING PARTNER &

CO-FOUNDER

Multiple Founder & Crypto Influencer. Finance @ UC Berkeley, in Crypto since ‘13. Helped Scale Fintech start-up MX.com from 2-28M users.

COO, Former COO Global

Equites, HSBC

20+ years in global investment banking and crypto hedge funds, specializing in equities, crypto execution technology, operations, risk, and compliance

CFP(R) GENERAL PARTNER

& CO-FOUNDER

6+ years at Merrill Lynch, Runs $100M+ AUM Private Weath Management Practice, Crypto Investor since ‘14.

MANAGING PARTNER &

CO-FOUNDER

Multiple Founder & Crypto Influencer. Finance @ UC Berkeley, in Crypto since ‘13. Helped Scale Fintech start-up MX.com from 2-28M users.

COO, Former COO Global

Equites, HSBC

20+ years in global investment banking and crypto hedge funds, specializing in equities, crypto execution technology, operations, risk, and compliance

CFP(R) GENERAL PARTNER

& CO-FOUNDER

6+ years at Merrill Lynch, Runs $100M+ AUM Private Weath Management Practice, Crypto Investor since ‘14.

General Partner & Fund Selection

Prolific crypto quant fund investor with 10+ years experience in crypto. Lead crypto partner at $100M VC fund. Invested in 300+ projects since 2016.

Amphibians Are Adaptable and Can Leap, Far. They Are Also Resilient.

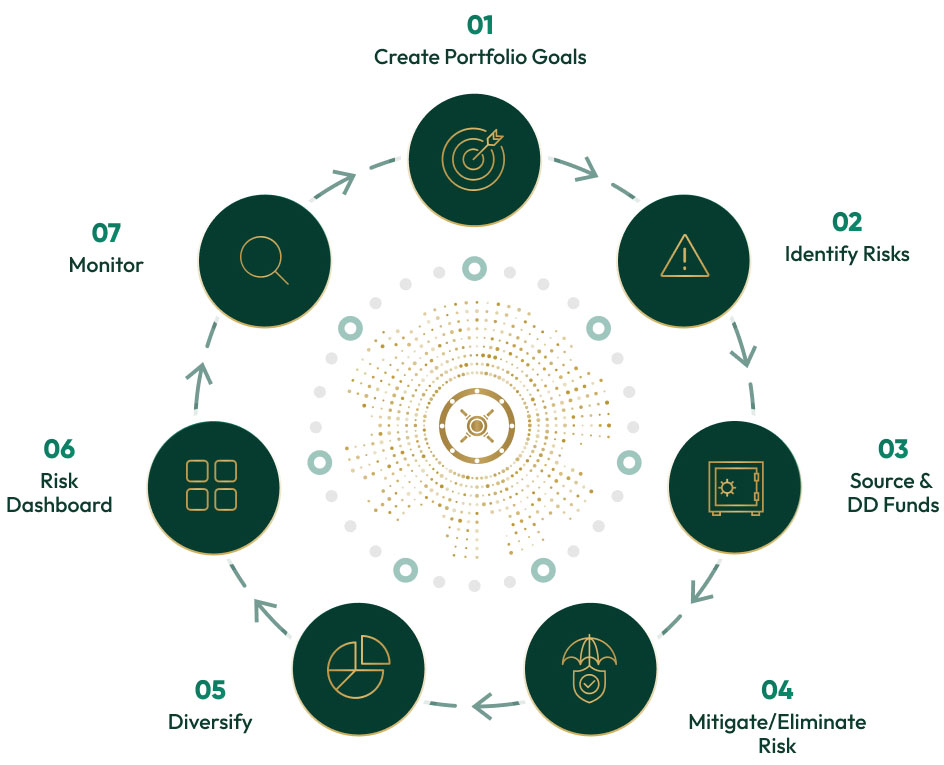

Our approach to risk management.

When most people hear ‘consistency’ in Digital Assets, they often take a second look. Therefore we get to approach things DIFFERENTLY. With 30+ GPs and team members including former CIO fixed income at Blackrock, Co-CIO at Panterra/current crypto partner at Founders Fund, ex Partner at PIMCO, Former COO Global Equities at HSBC etc, we bring a wealth of knowledge and expertise to the space.

Our Framework for Managing Risk in Digital Assets:

WHAT OUR CURRENT LPS ARE SAYING ABOUT AMPHIBIAN CAPITAL

There’s a level of consistency and repeatability that shows they have strong manager selection skills

“I’m an investor in Amphibian because I believe they’re the best crypto quant fund of funds. The return on my ETH has far exceeded my expectations, and there’s a level of consistency and repeatability that shows they have strong manager selection skills. This is a fund that operates with discipline and the foresight needed in digital assets.”

Joey Krug

Partner at Founders Fund Former Co-CIO Pantera Capital

I feel more informed and better positioned for long-term gains

I had moved a substantial part of my portfolio from tech stocks into the ETH fund of funds, just before the FTX chaos hit. The risk and volatility in late 2022 were beyond anything I’d faced, but Amphibian's team was ready. Todd and James calmed my nerves with clear, frequent updates and even personal conversations. Now, I feel more informed and better positioned for long-term gains, thanks to their unique strategy and seasoned leadership.

James Workman

Founder AquaShares Inc.

Their diligence in analyzing our trades and strategy is both thorough and highly specific.

"I’ve had the pleasure of working with Amphibian Capital for nearly three years. Their diligence in analyzing our trades and strategy is both thorough and highly specific. They possess a deep understanding of various risk types and the corresponding expected returns. Amphibian Capital stands out as the most sophisticated and knowledgeable fund of funds I’ve encountered in this industry.""

Hugo Xavier

Co-Founder and Head of Trading K2 Trading Partners

Consistently deliver results with a disciplined approach

“We’ve seen James and his team at Amphibian consistently deliver results with a disciplined approach. Our confidence as experienced allocators is unwavering.”

Bendik Loevaas

CEO Jigeum Capital

Highly skilled and genuinely focused on aligning with their investors’ goals

"I have a lot of confidence in Amphibian Capital's team and their thoughtful, steady approach to navigating the volatile world we live in. Their performance has been stellar since I invested. What I value the most is the trust I’ve built with their leadership. The team is highly skilled and genuinely focused on aligning with their investors’ goals. I feel like a true partner in their journey, which has been a meaningful experience and most importantly we are all aligned in having pure intention of giving back via donating a large proportion of profits to worthwhile causes."

Ben Arbib

Founder Nurture Brands

The balance between risk and performance is well articulated and transparent

"I have been very pleased with the consistent performance of the funds I am invested in and the professionalism of team at Amphibian Capital. The balance between risk and performance is well articulated and transparent and the founders have always been generous with their time to provide market insight and answer questions. Whilst the BTC and ETC funds don’t have a long track record, I wouldn’t hesitate to recommend Amphibian Capital to friends and colleagues due to reasons aforementioned, including reliability."

James Burbidge

Managing Director Deutsche Bank

What Our Current LPs Are Saying About Amphibian Capital

There’s a level of consistency and repeatability that shows they have strong manager selection skills

“I’m an investor in Amphibian because I believe they’re the best crypto quant fund of funds. The return on my ETH has far exceeded my expectations, and there’s a level of consistency and repeatability that shows they have strong manager selection skills. This is a fund that operates with discipline and the foresight needed in digital assets.”

Joey Krug

Partner at Founders Fund Former Co-CIO Pantera Capital

I feel more informed and better positioned for long-term gains

I had moved a substantial part of my portfolio from tech stocks into the ETH fund of funds, just before the FTX chaos hit. The risk and volatility in late 2022 were beyond anything I’d faced, but Amphibian's team was ready. Todd and James calmed my nerves with clear, frequent updates and even personal conversations. Now, I feel more informed and better positioned for long-term gains, thanks to their unique strategy and seasoned leadership.

James Workman

Founder AquaShares Inc.

Their diligence in analyzing our trades and strategy is both thorough and highly specific.

"I’ve had the pleasure of working with Amphibian Capital for nearly three years. Their diligence in analyzing our trades and strategy is both thorough and highly specific. They possess a deep understanding of various risk types and the corresponding expected returns. Amphibian Capital stands out as the most sophisticated and knowledgeable fund of funds I’ve encountered in this industry.""

Hugo Xavier

Co-Founder and Head of Trading K2 Trading Partners

Consistently deliver results with a disciplined approach

“We’ve seen James and his team at Amphibian consistently deliver results with a disciplined approach. Our confidence as experienced allocators is unwavering.”

Bendik Loevaas

CEO Jigeum Capital

Highly skilled and genuinely focused on aligning with their investors’ goals

"I have a lot of confidence in Amphibian Capital's team and their thoughtful, steady approach to navigating the volatile world we live in. Their performance has been stellar since I invested. What I value the most is the trust I’ve built with their leadership. The team is highly skilled and genuinely focused on aligning with their investors’ goals. I feel like a true partner in their journey, which has been a meaningful experience and most importantly we are all aligned in having pure intention of giving back via donating a large proportion of profits to worthwhile causes."

Ben Arbib

Founder Nurture Brands

The balance between risk and performance is well articulated and transparent

"I have been very pleased with the consistent performance of the funds I am invested in and the professionalism of team at Amphibian Capital. The balance between risk and performance is well articulated and transparent and the founders have always been generous with their time to provide market insight and answer questions. Whilst the BTC and ETC funds don’t have a long track record, I wouldn’t hesitate to recommend Amphibian Capital to friends and colleagues due to reasons aforementioned, including reliability."

James Burbidge

Managing Director Deutsche Bank

The testimonials provided are from Current Clients, Limited & General Partners of Amphibian Capital.

No compensation was provided for the statements, and the statements do not present any material conflicts of interests.

Lastly, Amphibians Have a Significant Impact on Their Ecosystems and at Certain Stages of Their Development, Are Regenerative…

That’s why we have designed Amphibian Capital to turn potential profits into good.

At the core of our vision and values is impact. This begins in the wider Digital Assets ecosystem and supporting risk management/ reducing counterparty Risk with our consortium of 159 of the world’s leading traders and funds. See the FT article here with the first tri-party agreement in Digital Assets, we helped launch with our Consortium, Sygnum Bank and Binance.

Expanding on that, we desire Amphibian Capital to be a regenerative financial machine that we can repurpose potential profits into supporting the future we desire to leave to our children. We have made a pledge that up to 50% of GP profits as we scale will be repurposed into impact-driven companies, organizations and non-profits.